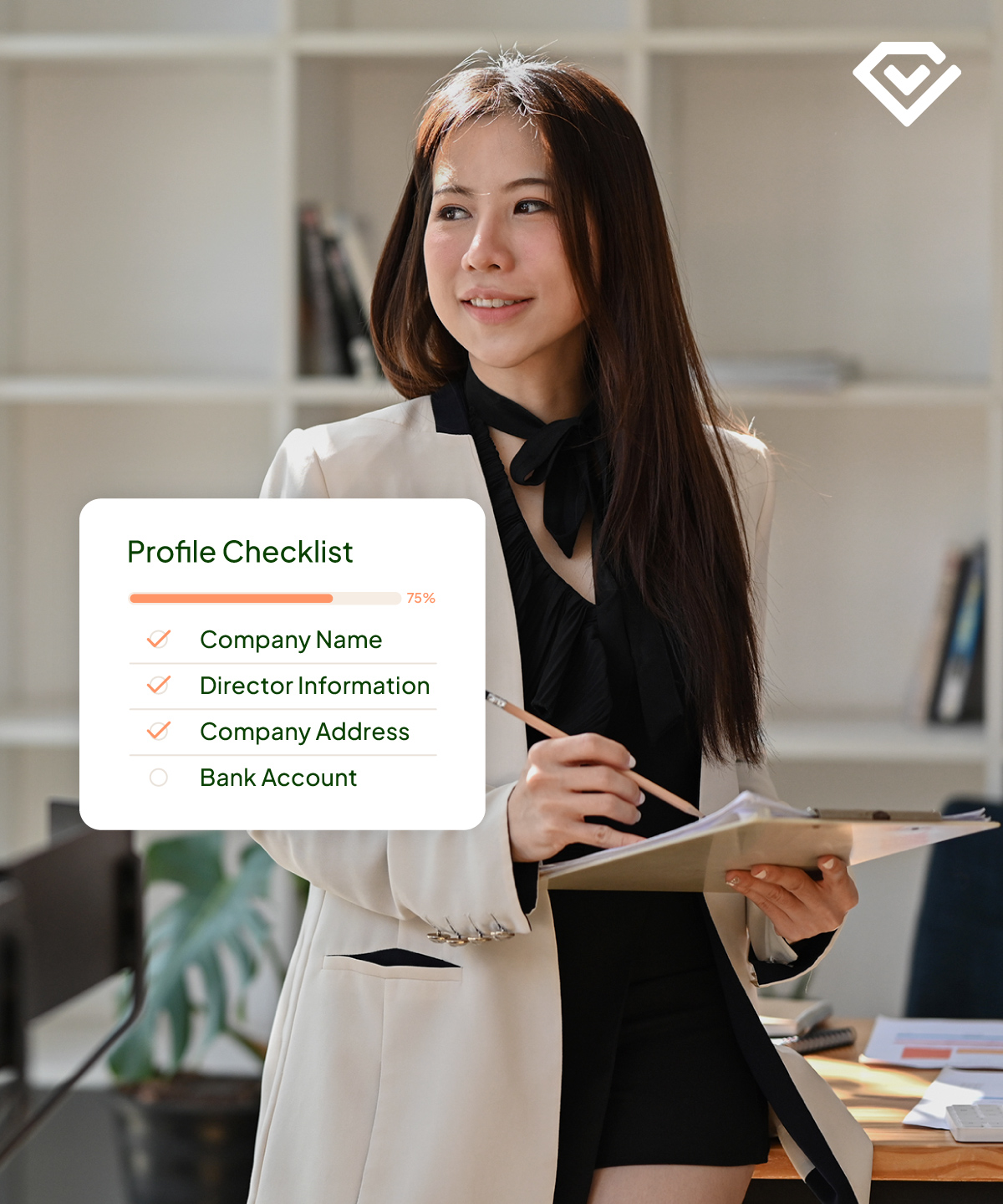

Company Incorporation Services in Singapore

Incorporating and registering a company can be a hassle and complex for many. At Vero, we handle the complexity for you. With just a few steps, we can help you to check if your preferred company name(s) is available and incorporate it accordingly in just a few steps.

Join hundreds of businesses using Vero.

Why choose Vero for your company incorporation?

Start your business quickly

Streamline your incorporation process with a professional who understands your new company’s legal obligations.

Register from anywhere

We handle the entire incorporation process for you, eliminating the need to deal with any paperwork.

Help opening a bank account

Receive expert guidance on choosing the right business bank account and referrals to our trusted industry partners.

Supportive Experts

Connect with our experts through phone for clear guidance and insights at every step of the registration process.

Incorporation plans to fit your business in Singapore

Explore incorporation plans tailored to your business needs in Singapore, offering seamless registration, compliance support, and expert guidance to set you up for success.

Essential

From business registration to annual ACRA filings, our plan ensures compliance so you can focus on growth.

S$400

Pre-incorporation consultation

- Appropriate group structure / business operating model

- Business objectives

- Tax structure (if applicable)

Incorporation

Business bank account

- Assistance in connecting with our banking partners

Compliance

Comprehensive support—from company formation to expert guidance and essential filings to keep your business compliant.

S$1,800

Pre-incorporation consultation

- Appropriate group structure / business operating model

- Business objectives

- Tax structure (if applicable)

Incorporation

- Pre-incorporation consultation

- Company name selection and reservation

- Company registration fee (inclusive of ACRA fees of S$315)

- Provision of post-incorporation documents

- Registration of registrable controllers

- Registration of personal data protection officer

- Free named secretary for 1st calendar year

- Free registered address for 1st calendar year

Business bank account

- Assistance in connecting with our banking partners

Minutes and resolutions

1st financial year only

Filings and returns

1st financial year only

Maintenance of registers

1st financial year only

Accounting and tax services

Add-on

Services

-

Website

Create customized, high-performance websites tailored to your business needs, ensuring functionality, scalability, and an exceptional user experience for your business from day one.

From S$1,000 -

Registered Company Address

Establish credibility with a professional registered address for your business. Meet compliance requirements while projecting a polished and trustworthy image.

S$300 / year

Choose the type of company you want to incorporate

A Private Limited Company (limited by shares) is a distinct legal entity, separate from its shareholders and directors. Despite this, the registration process is straightforward.

Pros

Shareholders of a Private Limited Company are not liable for any company debt beyond their share capital

- The corporate income tax is between 0% and 17%

- Newly established Singapore-registered companies can qualify for a few tax exemptions

- Shareholding can be either local or foreign

- The company can own property in its name

Cons

- The Singapore Companies Act allows a maximum of 50 shareholders for every Private Limited Company

- Shares are not made available to the public

The process of setting up a Branch Office is similar to a Subsidiary Company, however it is considered an extension of the parent company, rather than a separate legal entity.

Pros

- 100% foreign ownership allowed

- Ability to enter contracts on behalf of the parent or holding company

- Leverage of the foreign company's name to drive the business forward

Cons

- The parent company is liable for any losses

- The Branch Office is restricted to the same constitution as the parent company

- A parent company is required before setting up a Branch Office

A Sole Proprietorship has one owner who is personally responsible for any profit and losses. The business and its director are considered as a single entity.

Pros- All profits belong to the owner

- Revenue is taxed at personal income tax rate so annual return filing does not apply

- Less government compliance obligations compared to other business types

- The owner is responsible for any losses or debt, putting your personal assets at risk

- A Sole Proprietorship is not entitled to the same tax exemptions and rebates as corporations

This type of business can be owned by a minimum of two individual(s) and a company, the owners of a Partnership have limited liability much like the shareholders of a Private Limited Company.

Pros

- As this is a separate legal entity, partners are not liable for any company debt beyond their share capital

- Partnerships file income tax statements instead of annual returns

- Less government compliance obligations compared to a Private Limited Company

Cons

- Transfer of ownership is more complicated than doing this with a Private Limited Company

- Less consumer-focused image than other types of businesses

Have any question?

Schedule a call with our expert.

Schedule a convenient time to chat with our incorporation experts and get the answers you need to move forward.

Helping you succeed in getting started

We handle your company incorporation

We manage the entire process entirely online. From collecting your documents to completing KYC checks for all directors and shareholders, we handle every detail. We prepare and submit the necessary documents to the Singapore government agency and upload all your data securely to your Vero account.

Assist in bank account opening

We partner with a variety of local banks that can open a business bank account for you remotely online. Our partners include Aspire, DBS, OCBC and UOB. We present you to the banks, but we can’t guarantee you’ll get an account for your business. The decision is always up to the banks.

We set up the business routine

From registration to tax, compliance, and accounting services, our local accountants will support you from day one and beyond.

Frequently asked questions

To incorporate a company in Singapore, you need at least one shareholder, one director who is a Singapore resident, one company secretary, a local registered address, and an initial paid-up capital of at least SGD 1.

Incorporation in Singapore is typically quick. Once all required documents are submitted, the process can take 1-2 days if there are no complications.

Required documents include identification and proof of residence for all directors and shareholders, a constitution (formerly known as the Memorandum and Articles of Association), and details of the company structure.

Yes, a local registered address is mandatory. However, it does not need to be a commercial office; a virtual office or residential address may be acceptable under certain conditions.

The most common type of company is a Private Limited Company (Pte. Ltd.), which offers limited liability protection. Other types include sole proprietorships, partnerships, and branch offices for foreign companies.

Singapore companies must file annual returns, prepare financial statements, hold an Annual General Meeting (AGM), and comply with tax regulations, among other statutory requirements.

Yes, you can change the company name, registered address, directors, and other company details after incorporation by filing the necessary changes with the Accounting and Corporate Regulatory Authority (ACRA). Approval may be required for certain changes, such as the company name.