For foreigners who are looking to establish and register a company in Singapore

Join hundreds of businesses using Vero.

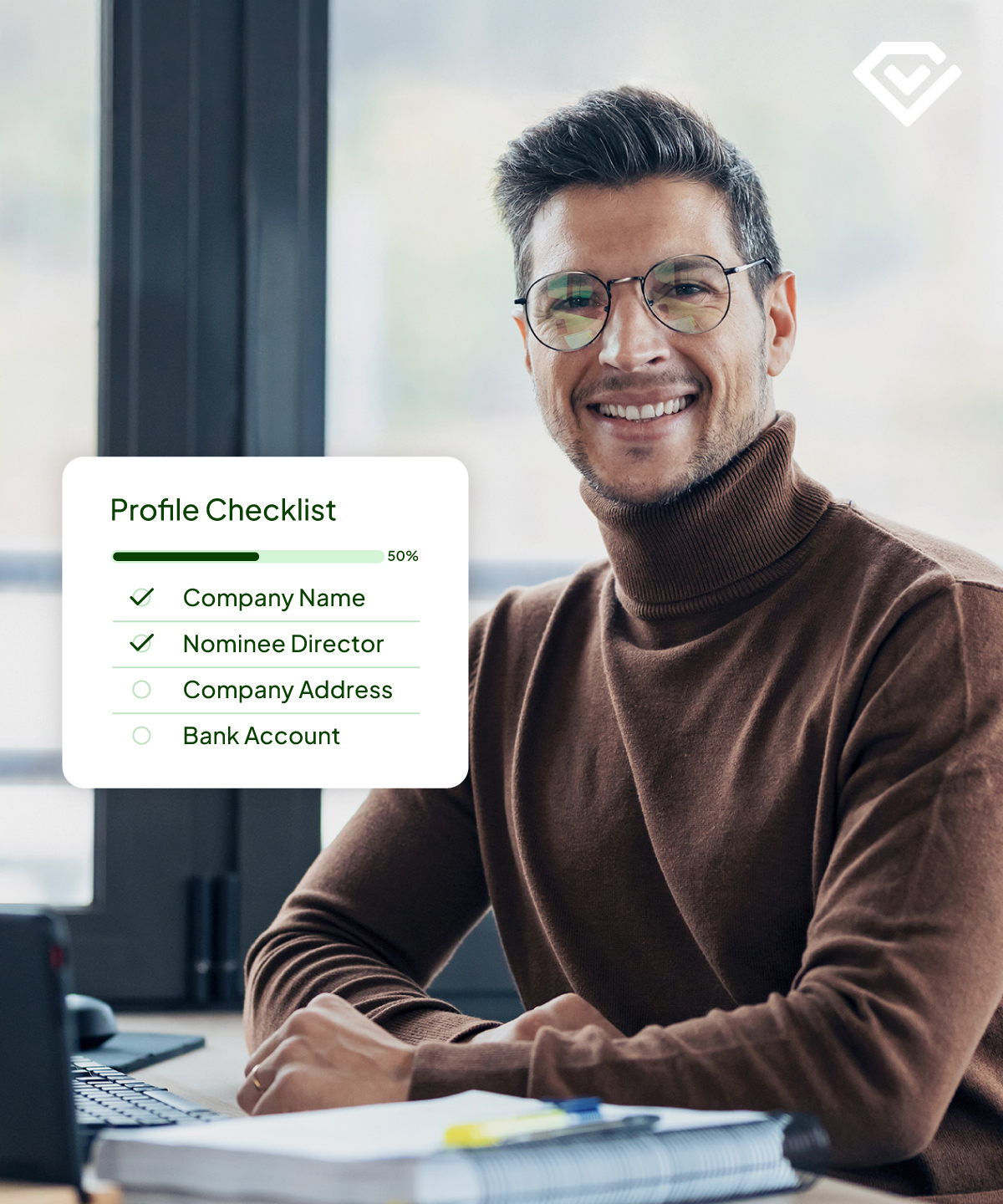

Online company registration with step-by-step guidance for foreigners

Start your business quickly

Streamline your incorporation process with a professional who understands your new company’s legal obligations.

Register from anywhere

We handle the entire incorporation process for you, eliminating the need to deal with any paperwork.

Help opening a bank account

Receive expert guidance on choosing the right business bank account and referrals to our trusted industry partners.

Supportive Experts

Connect with our experts through phone for clear guidance and insights at every step of the registration process.

Costs of company incorporation in Singapore

Essential

From business registration to annual ACRA filings, our plan ensures compliance so you can focus on growth.

S$600

Pre-incorporation consultation

- Appropriate group structure / business operating model

- Business objectives

- Tax structure (if applicable)

Incorporation

Business bank account

- Assistance in connecting with our banking partners

Compliance

Comprehensive support—from company formation to expert guidance and essential filings to keep your business compliant.

S$1,800

Pre-incorporation consultation

- Appropriate group structure / business operating model

- Business objectives

- Tax structure (if applicable)

Incorporation

- Pre-incorporation consultation

- Company name selection and reservation

- Company registration fee (inclusive of ACRA fees of S$315)

- Provision of post-incorporation documents

- Registration of registrable controllers

- Registration of personal data protection officer

- Free named secretary for 1st calendar year

- Free registered address for 1st calendar year

Business bank account

- Assistance in connecting with our banking partners

Minutes and resolutions

1st financial year only

Filings and returns

1st financial year only

Maintenance of registers

1st financial year only

Accounting and tax services

Add-on

Services

-

Website

Create customized, high-performance websites tailored to your business needs, ensuring functionality, scalability, and an exceptional user experience for your business from day one.

From S$1,000 -

Registered Company Address

Establish credibility with a professional registered address for your business. Meet compliance requirements while projecting a polished and trustworthy image.

S$300 / year

Key steps and requirements of incorporating a foreign-owned company in Singapore

1. Preparation of required information and documents

We assist you in preparing the required information for submission to ACRA.

Corporate Secretary

Under the law, every company in Singapore is required to appoint a company secretary. The secretary is responsible for ensuring compliance with all statutory requirements e.g. filing of annual returns, preparing resolutions and Annual General Meetings, among others.

Nominee Director

Nominee directors are bound by fiduciary duties to act in the best interests of the company. They must comply with local laws and regulations, including avoiding conflicts of interest and ensuring the company’s actions are lawful.

For any foreign-owned company, at least one of the directors must be a Singapore resident. This individual may be a Singapore citizen or a Singapore Permanent Resident or an Employment Pass holder.

Registered Address

It is a requirement for all Singapore-incorporated companies to have a local registered address. All legal documents e.g. bank statements and government correspondence are delivered to the registered address.

2. Company set-up and registration

Foreigners must fill in personal information and the company structure.

Information required including nature of business, “Know-Your-Client” disclosures for shareholders and directors, particulars of shareholders and directors and the shareholding compositions. All these can be easily collated using our online system.

3. Open your business bank account

We work closely with local and foreign banks based in Singapore for our client’s banking needs.

Opening of bank accounts generally can be done remotely. However, they are subject to individual banks’ discretion in accordance with their respective rules and procedures.

4. Obtaining employment pass to work in Singapore

The shareholder(s) and/or director(s) of a foreign company may choose to work and base in Singapore. To do so, the individual must apply for Employment Pass.

For those with families, Dependent Passes are required for their spouses and children.

We can assist in the application for the above passes and navigate the application process.

We can help you to be successful in Singapore

Experts in Incorporation

Our experienced advisors can guide you in managing the process of incorporation namely appointing local directors, company secretaries and auditors (where applicable) with full legal compliance.

Bank account opening

Your success is our pride

Frequently asked questions

No, physical presence is not required. The entire incorporation process can be handled remotely with the assistance of a corporate service provider.

Yes, Singapore law requires at least one director to be a Singapore resident (a citizen, permanent resident, or Employment Pass holder). You can appoint a nominee director if you do not meet this requirement.

A nominee director is a local resident appointed to fulfill the legal requirement of having a Singapore resident director. They do not participate in the management or operations of your company.

To work for your company in Singapore, you must apply for an Employment Pass or EntrePass. These permits are subject to approval by the Ministry of Manpower.

Some banks in Singapore allow remote corporate account opening, especially digital banks like Aspire. Traditional banks may require in-person verification.

Yes, Singapore offers attractive tax benefits, including a low corporate tax rate of 17%, tax exemptions for startups, and no capital gains tax. These benefits apply equally to foreign-owned companies.

You need a local registered address in Singapore, but it does not have to be a physical office. Virtual office services are available and widely used by foreign entrepreneurs.